How to write a family loan agreement: A step-by-step guide.

)

When you decide to loan money to a family member, especially for something as significant as purchasing a property, it’s essential to formalise the agreement to avoid misunderstandings. A family loan agreement not only protects both parties but also ensures that the expectations around repayment are clear from the start.

In this blog, we’ll walk you through how to write a family loan agreement and what elements to include to make sure it’s legally binding and beneficial for everyone involved.

Your family’s peace of mind is just a conversation away. Book a 10-minute chat with us today to understand your options.

Why You Need a Family Loan Agreement

Loaning money to a family member can be a delicate situation. While trust is already established, things can get complicated if circumstances change. Creating a family loan agreement helps to:

- Set clear expectations for both parties.

- Avoid future disputes over repayment terms.

- Ensure compliance with tax and legal obligations.

- Protect the financial interest of both the lender and borrower.

Even if the loan is informal and interest-free, a written agreement brings structure and clarity.

Key Elements of a Family Loan Agreement

When drafting a family loan agreement, it’s crucial to include the following sections:

1. Loan Amount and Purpose

Clearly state the amount of money being loaned and what it will be used for. For example:

"The lender agrees to loan the borrower [loan amount] for the purpose of assisting with the purchase of a residential property located at [property address]."

This provides clarity on the exact amount loaned and how it is intended to be used.

2. Loan Term

Specify the duration of the loan, which could be a fixed period (e.g., five years) or an open-ended term. If there is a specific date by which the loan must be repaid, mention that as well:

"The borrower agrees to repay the loan within [loan term], with the final payment due on [specific date]."

Including a specific time frame keeps both parties on the same page about repayment expectations.

3. Interest Rate (if applicable)

If the loan includes interest, outline the rate and how it will be applied. Even if you’re offering a lower-than-market interest rate, it’s essential to specify this in writing.

If the loan is interest-free, make that clear too:

"The loan will carry an interest rate of [interest rate] per annum, calculated on the remaining principal balance. Interest will be charged on a [monthly/quarterly/annual] basis." or "This loan is interest-free."

4. Repayment Schedule

Include details about how and when the borrower will make repayments. You can set up monthly, quarterly, or annual payments, depending on what works best for both parties. Make sure to outline the exact amount of each payment:

"The borrower agrees to make monthly payments of [payment amount] to the lender, starting on [start date]. Payments will be due on the [specific day] of each month."

5. Late Payment Terms

It’s important to include terms for what will happen if the borrower misses a payment or cannot meet the repayment schedule. Will there be penalties for late payments? If so, detail them:

"If the borrower fails to make a payment by the due date, a late payment fee of [amount] will be charged. The lender reserves the right to take legal action if the borrower defaults on the loan."

This section is crucial for protecting the lender’s interests and encouraging timely payments.

6. Collateral (if any)

If the loan is secured by collateral, such as a share in the property or other assets, be sure to specify the terms:

"As security for the loan, the borrower agrees to provide the lender with a [description of collateral]. In the event of a default, the lender has the right to take possession of the collateral."

If no collateral is involved, simply state:

"This loan is unsecured."

7. Early Repayment Terms

Include provisions for what happens if the borrower wants to repay the loan early. Will there be any penalties, or is early repayment allowed without additional costs?

"The borrower may repay the loan early without incurring any prepayment penalties."

Early repayment flexibility can make the loan more attractive for the borrower.

8. Signatures and Witnesses

For the agreement to be legally binding, it’s essential that both parties sign the document. In many cases, it’s also a good idea to have the agreement witnessed by a third party:

This agreement is signed and dated by both parties on [date].

Borrower’s Signature:

Lender’s Signature:

Witness Signature:

Witnesses can help ensure that both parties fully understand the terms and that the agreement is legally enforceable.

Additional Considerations for a Family Loan Agreement

Tax Implications

When loaning money to a family member, it’s important to consider the tax implications for both the lender and borrower. For instance, interest earned on the loan might need to be declared as taxable income. In some jurisdictions, certain loans may also be subject to gift tax if the interest rate is below market rates. It’s always a good idea to consult a tax advisor or financial planner before finalising the loan agreement.

Get Legal Advice

While you can draft a family loan agreement on your own, it’s often wise to consult a legal professional to ensure the contract meets the requirements of your local laws. This can help avoid any future disputes or misunderstandings.

Record Payments

Both parties should keep a clear record of all payments made under the loan agreement. This can be done through bank transfers with clear descriptions or by using a loan tracking tool or app. Regular documentation can help prevent any disagreements over how much has been repaid or how much is still owed.

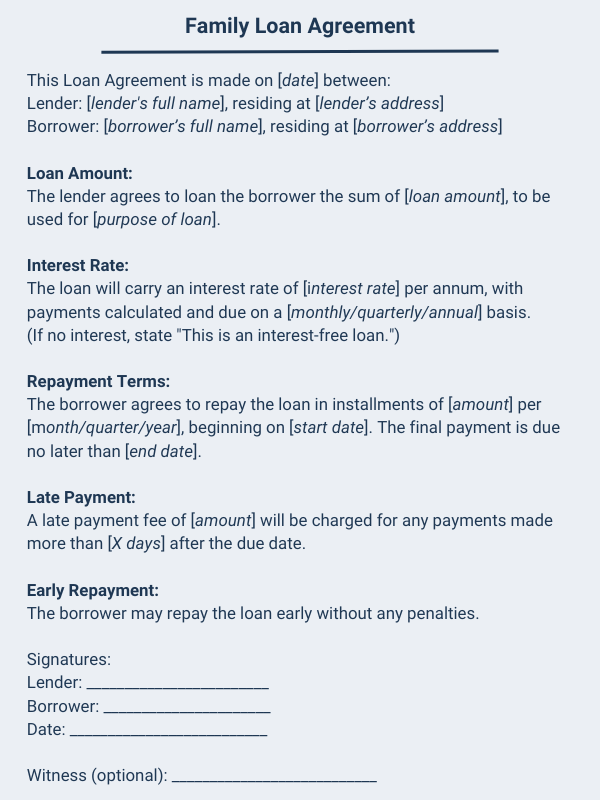

Sample Family Loan Agreement

Here’s a sample template to give you an idea of what a family loan agreement could look like. Be sure to adapt it to your specific needs and circumstances and seek legal advice.

A well-drafted family loan agreement is essential for ensuring both parties understand the terms of the loan and for avoiding future disputes. By including key elements such as loan amount, repayment schedule, interest rate, and late payment terms, you can protect your financial interests and maintain a positive family relationship. If you're unsure about any aspect of the agreement, consider seeking legal advice to ensure everything is in order.

When done right, a family loan agreement can help your loved ones achieve their financial goals—while keeping things clear and professional.

If you’d like to learn more about your options in supporting your children or get professional assistance in drafting your agreement, feel free to contact us at 1300 780 440 or book a 10-minute chat below.

) Author:Chris Collard

Author:Chris Collard| Tags:Home loansInterest ratesrepaymentsfamily loan agreementloan |