Psychology of Money

)

Have you ever wondered why you manage money the way you do?

Do you like to view your growing bank balance on your mobile app?

Perhaps you are a compulsive shopaholic showing little attention to how you will survive in the future?

You may think that your money behaviour comes from your parents, but research is proving our habits aren't just based on our money lessons learnt as kids. Experts are revealing that brain chemistry plays a big role in your finance habits.

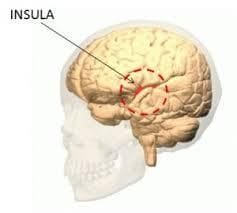

The Journal of Consumer Research by Rick Cyder observed activity in the area of the brain called the insula, which is stimulated when you experience something unpleasant. The more stimulation in the insula, the less likely you are to keep doing what you're doing. When it comes to money, insula stimulation can stop your spending.

"On the other hand, the act of saving either by having cash in a bank or by experiencing a significant savings on a product or service brings savers intense pleasure. The victory of a good bargain makes everyone feel good, but savers feel the rush even more since it's a relief from the discomfort of needing to spend," the research found.

Meir Statman, a behavioral economist at Santa Clara University uses this analogy: "If you go out to eat at a restaurant that typically charges $70 for a plate and you get your meal for only $7, it will taste better to you. But if you ate at that same restaurant without knowing the cost, you wouldn't enjoy your food as much. Knowing the total amount saved gives savers immense pleasure".

Researchers concluded that people who have more insula activity in their brains are more likely to be savers, while those with less tend to be spenders. Both extremes can end up with great regrets, which is why expert money management advice is essential.

Are you a saver or a spender? Take our Money Personality Quiz to find out.

) Author:Chris Collard

Author:Chris Collard| Tags:Smart Money ManagementFirst Home BuyersRetirementUpgrade My Home |