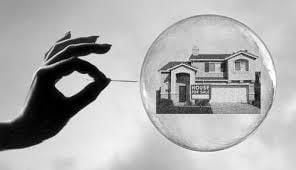

Is the property market about to crash?

)

Over the last 6 months this is one of the most common questions I have been asked. It's not a new question.

It comes around every so often, normally after clients have read an article in one of the daily newspapers or watched a Today Tonight expose' on the crash that has to happen.

I myself read an article last week that shared an overseas investment research houses assessment of our property market. For an overseas research house it was quite balanced and thorough but like many predictions it contained plenty of outs in the event their predictions were wrong.

One prediction was if certain events were to happen we would see a property crash where prices would fall by between 5% and 10%.

History would suggest on average when our property market corrects (and again lets be clear there are multiple markets, states, suburbs, streets and dwelling types) the best performing properties might correct by up to 5% while poorer performing properties have corrected by 10%.

If you have bought a certain type of property in an area where oversupply is a significant issue (see mining towns and high density apartments sold at above market prices) then you could see reductions of up to 20%.

But if you own a home in metropolitan Sydney or Melbourne, the cities experts are suggesting are most exposed to a "crash" you would be looking at your home dropping in value from $800k to $750k, should a drop occur.

History suggests it then takes a couple of years to recover and make its way back to $800k.

End of the world? Hardly. Unless of course you have borrowed more than the place is worth AND you are unable to meet your mortgage repayments and need to sell.

The reality is that property prices will correct themselves at some point, just as they have done many times before.

The most important thing you can do is ensure you have the capacity to repay your debt. Not just at today's interest rates but also tomorrow's and always have a contingency in place if you were to lose your income.

If you actually want to benefit from this "property crash" and the opportunities it will present then make sure you call us so we can put a plan in place by:

1. Getting an understanding of what your property or properties are currently worth.

2. Make sure your strategy for reducing your home loan debt is working.

3. Ensure you have equity within your home and your loan is structured correctly to enable you to get access to it.

4. Make sure you understand your borrowing capacity so you are ready to capitalise on any opportunities that present in the future, if building wealth through property is something you would like to do.

Call us today on 1300 780 440 for a chat.

) Author:Mark Attard

Author:Mark Attard| Tags:Property InvestmentPropertyreal estateSmart Money ManagementFirst Home BuyersBuilding WealthUpgrade My Home |