Posted in Smart Money Management

50 high growth suburbs

Posted by Mark Attard

on 27 September 2016

)

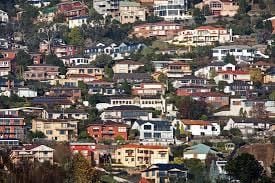

Research is key to understanding the best investment suburbs in Australia, and here's one report not to be missed.

If you're looking to buy property before the year is out, this is a must-read report.

Real Estate Investar has collated this list of 50 high growth suburbs in Australia. Researchers have analysed recent market rental and sales listing data, which includes both a dwelling type and bedroom number level.

Remember, while this report is designed to illustrate pote...

Remember, while this report is designed to illustrate pote...

| Posted in:Property InvestmentFinancial planningInvestmentPropertysuburbUpgrading your HomeSmart Money ManagementBuilding Wealth |

Good vs bad debt

Posted by Mark Attard

on 27 September 2016

)

Plus, why having a tailored debt reduction plan matters.

If you're like most people trying to get ahead, you have probably heard of the terms 'good debt' and 'bad debt'.

So, what do they each mean? And, can any sort of debt REALLY be a good thing?

Put simply, while there are many definitions of what constitutes good vs bad debt, broadly speaking here's the deal:

GOOD DEBT

Good debt is debt that's used to increase your net worth by buying assets...

Good debt is debt that's used to increase your net worth by buying assets...

| Posted in:DebtBad debtgood debt vs bad debtSmart Money ManagementBuilding WealthReducing Debt |

What successful people wish they'd known in their 20's

Posted by Chris Collard

on 13 September 2016

)

We don't all learn from our mistakes.

If you're in your 20's (30's or 40's!! :) Check out this Business Insider article which shares insights from influencial people who have built wealth over the years.

Read here to find out what they had to say.

First step to managing your money better, take a look at Your Smart MoneyTool.

...

| Posted in:Financial planningSuccessmistakesSmart Money ManagementBuilding Wealth |

8 tips to build wealth like millionaires do

Posted by Mark Attard

on 13 September 2016

)

Make it a game!

We've all had a genius idea at one point and wondered if and how we can make money from it. Turns out we maybe onto something, we just need to sell it - simple!

Liz Davidson from Financial Finesse gives us 8 ways we can build wealth like millionaires. Put aside some of the american terms and focus on some the simple ideas put forward in the article. Remember often the best business ideas are the simple ones. We love the idea of throwing parties and s...

| Posted in:Smart Money ManagementBuilding WealthReducing Debt |

Scared to invest in property? These 5 tips will help

Posted by Mark Attard

on 30 August 2016

)

Learn how to overcome your fear of investing.

If you're reading this blog, chances are you're giving some serious consideration to investing in property to help build your wealth and improve your financial security.

After all, you've probably heard about the advantages of owning an investment property such as the tax deductions, having a tenant pay off the mortgage for you, and the fact that property values in Australia double on average every seven to 10 years.

But...

| Posted in:Property InvestmentSmart Money ManagementBuilding Wealth |